Words by David Smith

The business aviation world has been slow to introduce digitalization, lagging even the trucking sector. There are several reasons for this. Private aviation is more complex than commercial aviation, there is less incentive to create software for a relatively small industry and there is market resistance to transparency. But a number of companies are beginning to embrace digitalization.

“New digital approaches are needed in the brokered private jet aviation world to create real transparency. Whereas passengers on commercial aircraft have a good understanding of their options, choices and prices, in private aviation there is zero transparency,” says Richard Hekker, cofounder of a new online marketplace Opes Jet, which facilitates a direct interaction between operators and clients.

The experiences of both the operator and high-net worth passengers is dominated by brokers, according to Hekker, and many clients are happy to use brokers because they provide “a tailor-made suit” for passengers with specific requirements. Those clients want a reassuring person at the end of the phone promising everything they want. Haggling about price is the last of their concerns.

But Hekker believes a small proportion of passengers, and a high number of operators would like to see more transparency. His initial goal is to gain 5% of the market by targeting passengers wanting more transparency. “A client will almost never know the true cost of their flight paid to an operator net of any additional kickbacks or discounts, but only knows what their broker charges them for their flight. The top professional brokers will charge their clients, on average, between 10-15% commission, while Opes Jet will charge clients a fixed fee of only 4% – on a fully transparent charter amount.”

The financial recompense to a broker can be even greater if an operator can offer an empty leg at a discounted price. “The broker could inform his client that he has done a fantastic job securing a larger aircraft at a discounted price. The client will be happy, while the broker has now made more commission.

“Despite their pivotal role, brokers are unlicensed, and unregulated. Essentially, anyone with a phone and an email address can set up as a broker today and start selling flights to clients,” says Hekker.

Conversion costs

The larger brokers have tens of thousands of clients and hold the power to negotiate with both sides without any obligation to reveal the nature of those talks. Meanwhile, operators take many risks and often manage fine profit margins. “It’s tough. Operators could receive 100 requests for flights through broker platforms, but usually only convert 1% into sales,” says Hekker.

The cost to operators of listing aircraft on the larger broker platforms can be high. Unfortunately, listing an aircraft on a platform doesn’t guarantee an operator any business, but only ensures that their aircraft can potentially be found.

Hekker’s idea for Opes Jet is to create a platform that allows pre-approved ultra-high-net worth individuals to search directly for flights. At the same time, he built a separate platform where operators can list aircraft, submit flight offers, and interact with clients directly.

“Our platform is completely free for operators because we consolidated all cost on to the client. Offers go straight to the clients and we don’t filter or interfere. So, if the operator has an empty leg and can do it for €5,000 [US$5,600], that’s the offer the client will receive,” says Hekker.

“It’s a numbers game for us, where all the clients and operators share the benefits. We want to build something like what Airbnb did for rooms,” he adds.

For the operators, greater transparency has the advantage that they get to see competitors’ real quotes on the Opes Jet platform, not just a cost estimate. This means an operator can know in advance when they cannot be competitive quoting for a flight, and avoid wasting their time calculating the offer.

Meanwhile, clients will be pleasantly surprised when they begin receiving cheaper offers than they are used to paying.

Asset management

Marc Knapp is CEO of Germany-based JetManager, a company which provides software for business aviation aircraft. He believes there is a low incentive to write software for the business aviation sector. “The market is high in revenue, but small in volume, so it hasn’t attracted developers. The sheer complexity of writing software is another factor,” he says.

Nevertheless, Knapp has seen growing demand for his JetManager software. The company’s biggest client is Air Alsie in Denmark. The software is managing 38 aircraft charter firms. According to Knapp operators are beginning to realize the disadvantages of old-fashioned methods. “Often, they’re running their businesses with pen and paper, or Excel at best. Information is siloed and unconnected with other data systems. They’re also often using at least two software systems and data is mostly unverified. It can be a complex process to digitalize an entire business when it’s acted like that for so long,” he says.

A single-aircraft operator might cope, he argues, with primitive, paper-based methods. But as the organization becomes a multi-fleet, global operation, it becomes harder for staff to log onto several software systems each day, or manually keep track of all the data. Lack of efficiency in finance departments leads to delays in payment processes.

“It takes so long until the invoices come in, and you have to pay the fee for de-icing and other services once it’s over. Reconciliation can take months, so operators are in the dark,” says Knapp. “We unify processes so an aircraft owner can log in and see everything they need to know about their aircraft, how many hours it’s done, how much revenue it is earned.”

The use of blockchain technology creates an immutable ledger of each aircraft’s details. When the owner sells the aircraft, the digital file lists everything. With paper-based processes, office workers would have to track down, then scan and photocopy material. “We are trying to reduce the friction in communication using real-time data,” says Knapp.

Digital transformation, however, is harder than it sounds to implement. Knapp believes there is often a deep-seated fear among employees that a machine will take away their jobs. “We have to explain that human beings are good at creativity and problem-solving. The machine does the tedious data shuffling, allowing you to make better decisions. It’s about augmenting human intelligence,” he says. “But for it to work the management needs to tell people not to be afraid of losing their jobs, give them training and explain where the organization is heading.

“It’s also a good idea to get trusted insiders on board to help with implementation and begin the whole complex process with projects that offer significant rewards and manageable levels of risk.”

Data security

Resistance to digitalization can extend to cyber security, he says. With VIPs in the database, it is crucial to carefully control access to data. Knapp says, “I still have discussions with operators who don’t want to use two-factor identification because it is inconvenient. But if there is a data breach it could mean the end of their operations – all trust is destroyed.”

To defend against cyber attacks, Hekker never requests sensitive data, such as passport copies, or children’s names. If it is relevant to the flight, clients should submit the information to the operator directly. Details are stored in individual digital containers by Opes Jet. “They are individually encrypted, so if someone hacked into the system, they might be able to access data for one specific client if the know what they are looking for, but they could never piggyback on that hack across all other client content.”

Benchmarking costs

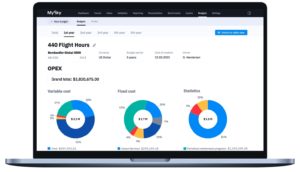

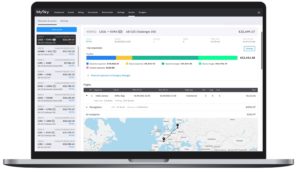

MySky is an AI-powered spend-management platform for business aviation that is sometimes used in conjunction with the JetManager software. Chris Marich, who founded the company in Switzerland six years ago, says JetManager is more focused on operations, whereas MySky provides operators with data about running costs for aircraft.

The information provided includes costs benchmarked against MySky databases. The company works with operators with one aircraft, all the way up to 50 aircraft. “The industry produces a lot of documents and invoices, and there is no standardization, which makes digitalization complex. We use optical character reading to extract data from paperwork and transform it into actionable data,” says Marich.

“Humans have a hard time knowing when they have been charged twice if crucial information is hidden in 80 lines of an invoice two months earlier. We take care of the paperwork so staff are free to do proactive things like calling suppliers.”

In March last year MySky introduced MySky Budget a tool that produces customized aircraft budgets. The software simulates flight activity to predict charter operating costs and potential revenue. The simulations are overlaid with actual running costs and regional data sourced through the company’s cost database. “It can give buyers and aircraft brokers a detailed view of how expected charter margins will support a private jet purchase,” he says.

This was followed by the launch of MySky Quote in September, a predictive tool for flight costs with a claimed accuracy of 96%, able to generate precise estimates for each leg of a charter mission.

Marich believes that to maintain growth in business and private aviation, digital transformation is vital.

“We’re late compared to industries like commercial airlines, hotels, car rentals. But we now have an opportunity to accelerate growth using technology,” he says.

“With more transparency, there is more motivation to be an owner. By making the market more competitive, we hope to participate in the industry’s growth,” says Marich.

“The industry has always had a top-down approach without understanding the costs. We aimed from the start for a bottoms-up approach to understand the costs.”